Beneficial! Why Is Equifax So Much Lower

While many of you may be aware that higher numbers on the scale translate to good credit scores the exact ranges of what constitutes a good or a bad score may not be clear. If you dont have an Equifax Credit Score its probably because you are not credit-active or havent applied or used credit.

Pin By Erica Newman On Life Hacks Credit Repair Letters Credit Repair Companies Credit Companies

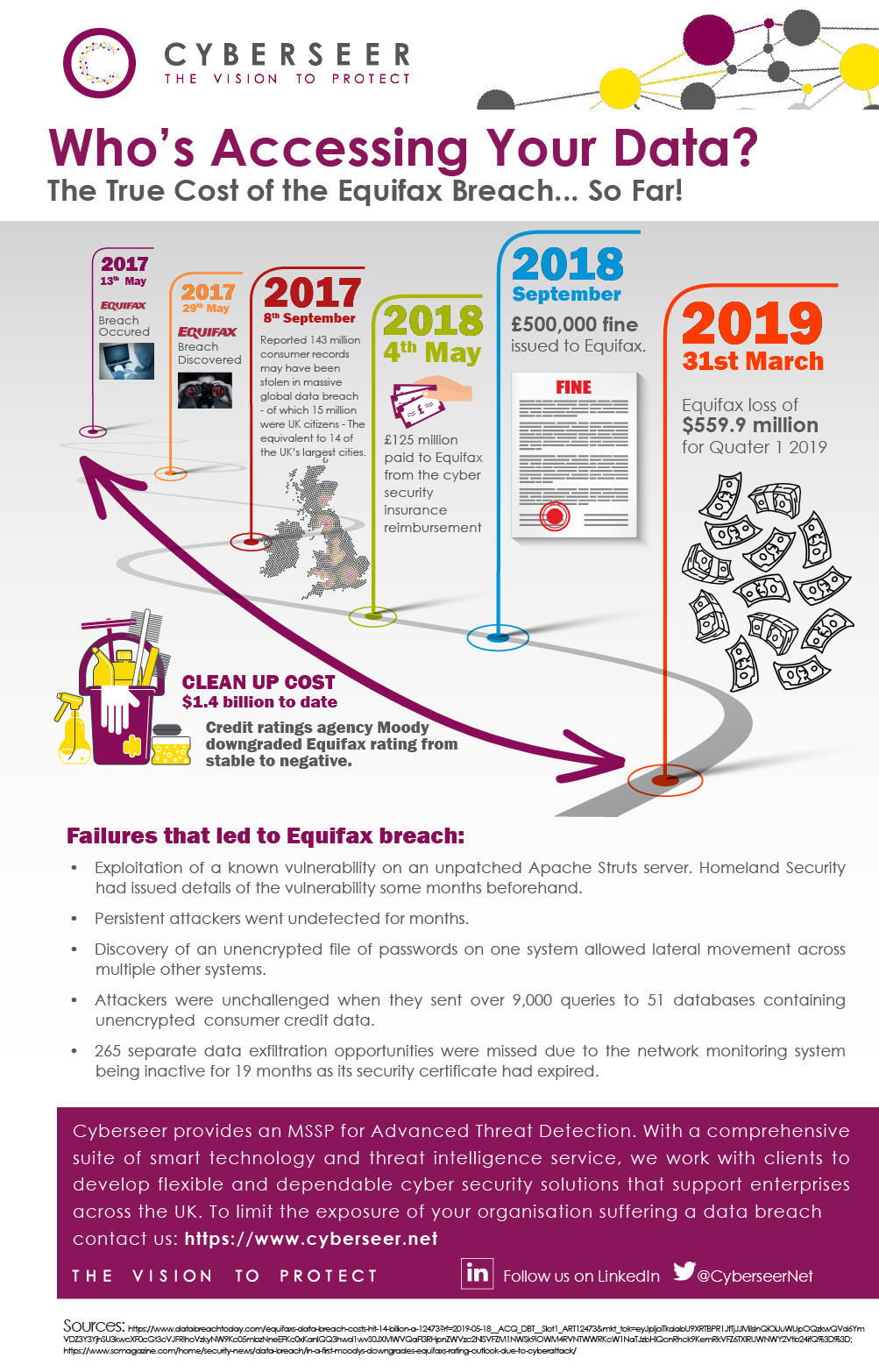

After Equifax failed to secure financial and other sensitive information belonging to 143 million US.

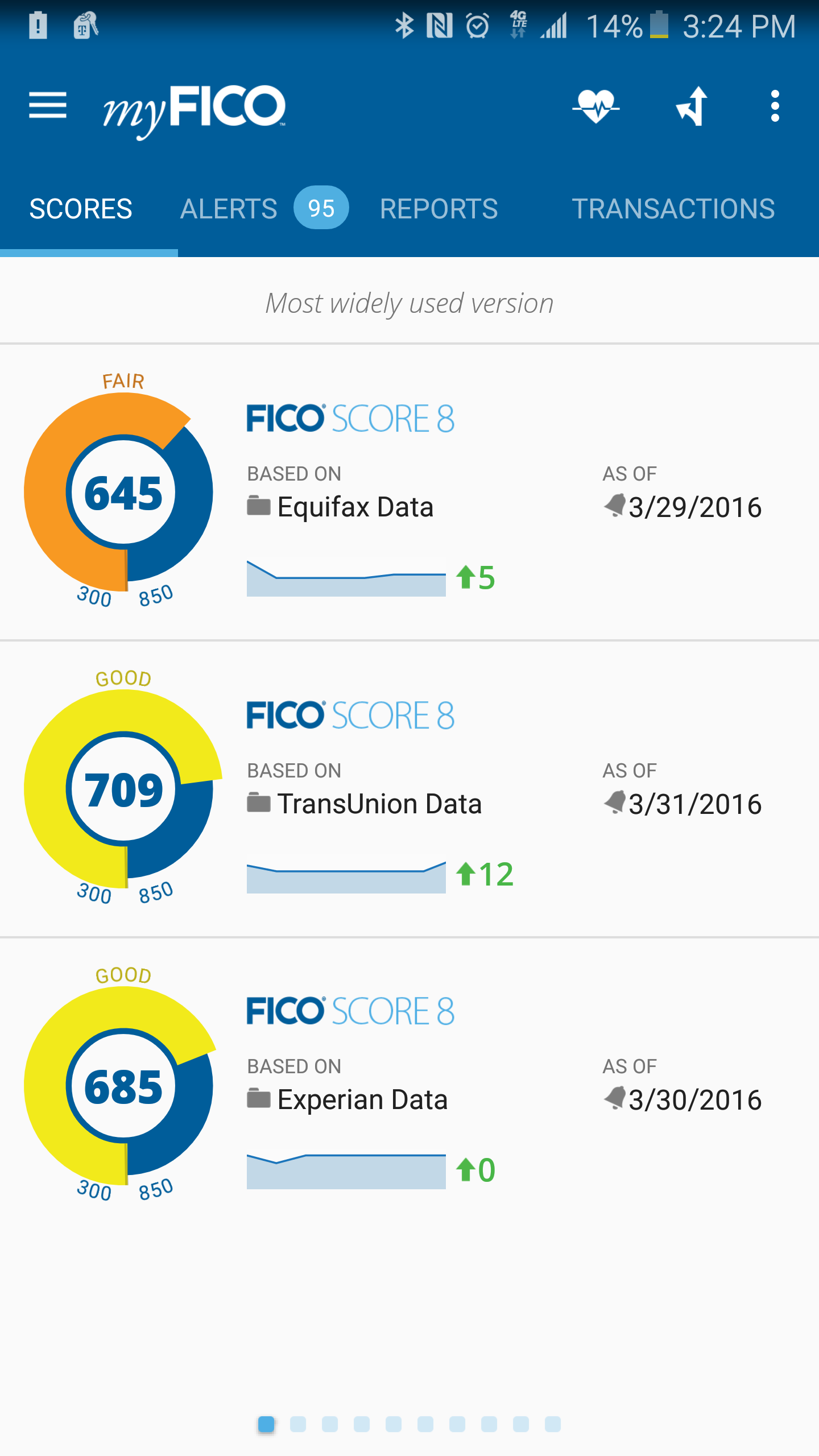

Why is equifax so much lower. While it is possible for you to have only one credit score its unusual. You can access your TransUnion VantageScore 30 credit scoreanother. Heres the scoop on how your FICO scores can affect your mortgage.

Consumers its no surprise that Americans are concerned very concerned in fact. A VantageScore is one of many types of credit scores. Still it uses the Equifax Credit Score Model when you purchase your credit score from their website.

By Christina Majaski Updated. Finally Equifax offers both FICO scores and VantageScores to lenders pulling credit scores on potential customers. How much Equifax Credit Score is good.

Children dont have Equifax Credit Scores and some older Australians and those new to Australia may not eitherI f you fall into one of the categories of insolvency such as bankruptcy you may not have a credit score either as Equifax does not score credit files. When the lender pulls three scores from Experian TransUnion and Equifax the middle number must be used for FHA qualification purposes. Thats why its important to understand the nuances of your FICO scores.

Equifax Credit Information Services LLC PO. If youre expecting a change to your Equifax score or report but it hasnt been updated yet it may be worth waiting for the weekly Equifax check before contacting lenders or credit bureaus. Find out why there are so many credit scores available on the market and which one is the most accurate when it comes to applying for loans and credit cards.

A second dispute letter should be sent to the credit reporting agencies with much the same information so they too are aware that the debt is in dispute. But it can be. Your PIN will be mailed to you.

CreditWise from Capital One can help with all of that. Dispute Credit Report Items. Often however the matter is not resolved until the information already has appeared on your credit report and thus become a negative factor that on your credit score.

Even then with the different algorithms the variance between the two scores should be between 7-10 or even less. If youd rather set up a security freeze via postal mail the address is. Luckily its not rocket science.

There are many reasons why the numbers between Equifax and Transunion may differ so much. Now that youve seen why credit is so important you may wonder how you can track it. In fact there are several reasons why your scores from Experian TransUnion and Equifax are typically different.

While the credit score range is the same as FICOs 300-850 its not the same thing. Creditors and lenders prefer to see a lower ratio of how much debt you have compared with how much available credit you have. Credit Scores are assigned in the range of 300-900.

Equifax Security Freeze PO. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. But one number is perhaps one of the most important numbers of all.

And unfortunately whenever theres heightened awareness around any big news or event it is pretty much guaranteed that the criminals are hard at work. One of which is that they use different algorithms to calculate your credit score. So choose shorter tenures as the interest amount will get much lower with time.

Equifax is a consumer credit reporting agency in the United States and is considered one of the three largest American credit reporting agencies along with Experian and TransUnionInformation that Equifax collects and is required by law to provide to consumers annually is included as part of three free credit reports available. When only one score is obtained that becomes the MDCS. Aside from knowing where you stand monitoring your credit can also help you spot reporting errors and potential fraud attempts.

Lets explore two ways to get your score right now. Use a home loan EMI calculator while comparing long-term and short-term home loans. Now thanks to the internet you can see your FICO score in minutes.

The cancellation may affect your debt to credit utilization ratio which is the amount of credit youre using as compared to the amount of credit available to you. Your FICO scores can impact whether you get a loan or not and if so at what interest rate. Its unlikely that youll have the same credit score across each of the three credit bureaus.

Developed by Fair Isaac and Company in 1956 the FICO scoring system initially flopped. Credit bureaus Credit bureaus didnt adopt FICO until 1991 and consumers didnt gain on-demand access to bona fide FICO scores until much later than that. Any score of 800 or above on the Equifax Credit Score is considered as excellent.

Box 105788 Atlanta GA 30348. Box 740241 Atlanta GA 30374. Reasons Why Your Credit Scores Differ From Bureau to Bureau.

Credit scores are generally calculated using information from from one or more of a persons credit reports from the three nationwide credit reporting agencies Equifax Experian and TransUnion. Place Fraud Alert on Profile. Equifax Credit Scores.

Make regular prepayments During the first few years of your home loan you will be paying more towards the interest charged and less towards the principal. When two scores are pulled from two of the three credit-reporting bureaus the lower number must be used to determine eligibility. Keep in mind that Credit Karma checks for updates to your TransUnion and Equifax scores and reports at different frequencies.

You can see your VantageScore credit score based on Equifax data for free here. Request Free Credit Report.

Former Equifax President Lists Canton Horse Estate At 13 5m One Of Top 10 In Ga Slideshow Atlan Driveway Entrance Landscaping Outdoor Design Luxury Homes

Equifax Vs Experian Vs Transunion Complete Credit Bureau Guide

Equifax Always Lower Mystery Solved 60 80 Pts Di Myfico Forums 4537391

Credit Score Ranges Experian Equifax Transunion Fico With Experian Credit Score Chart24331 Improve Your Credit Score Credit Score Chart Credit Score

Equifax Just Got Fined Up To 700 Million For That Massive 2017 Hack

Best Free Credit Report Template In 2021 Best Free Credit Report Report Template Dispute Credit Report

Experts Believe That Up To 35 Of Your Credit Rating Is Based On Your Paying Of Expenses On Time S Credit Repair Business Credit Repair Credit Repair Services

Equifax Mortgage Score 67 70 Points Lower Myfico Forums 6200801

Why Are Equifax And Transunion Scores So Different Debt Com

Late Payments Removed From Equifax Credit Repair Letters Paying Off Credit Cards Credit Repair

Why Your Credit Scores Can Vary So Much At Equifax Experian Transunion Mybanktracker

Why Your Equifax Credit Score Is Lower Than Transunion Fico Score

Free Credit Scores Credit Report Monitoring Credit Karma Credit Karma Free Credit Score Credit Karma Credit Score

Why Your Equifax Credit Score Is Lower Than Transunion Fico Score

The Ultimate Guide To Equifax Check Your Credit Report Score 2021

Who S Accessing Your Data The True Cost Of The Equifax Breach So Far

Why Your Equifax Credit Score Is Lower Than Transunion Fico Score

A Year Later Equifax Lost Your Data But Faced Little Fallout Techcrunch

Post a Comment for "Beneficial! Why Is Equifax So Much Lower"